Have you ever faced confusion or disputes during an employee exit process, wondering if your full and final settlement practices are robust enough to protect both the organization and the departing employee? If yes, you’re not alone. Many HR professionals, whether freshers or experienced, grapple with creating a transparent, efficient, and legally compliant F&F process—a critical element that can make or break your HR payroll settlement framework.

In this comprehensive blog, we’ll explore the definition and importance of the full and final settlement, delve into its components and legal guidelines (particularly in the Indian context), identify common challenges, and share best practices and tools to streamline the F&F settlement workflow. By the end of this article, you will have an actionable HR settlement guide to ensure an effective exit process that fosters goodwill and upholds compliance.

Full and Final Settlement (F&F) is the final stage of the employee exit process, wherein an organization clears all dues owed to an exiting employee—this includes unpaid salary, allowances, bonuses, and other employee dues, plus the necessary statutory contributions and deductions. An efficient final payroll calculation as part of an organized F&F process is vital for maintaining positive relations between the employer and employee, even after the employment relationship ends. This has become increasingly important with evolving HR best practices, where a seamless exit experience can enhance the organization’s brand reputation and reduce legal or financial risks.

Smooth Transitions: Timely and accurate settlements ensure the departing employee transitions out of the organization without lingering financial disputes.

Maintaining Goodwill: Proper HR payroll settlement reinforces a company’s commitment to fairness, which can lead to positive word-of-mouth and employer branding.

Legal Compliance: Non-compliance with Indian labor laws and statutory regulations can lead to penalties or lawsuits. A robust F&F settlement compliance framework protects against these pitfalls.

1.1. Overview of Full and Final Settlement

Full and Final Settlement (F&F) refers to the process by which an employer settles all financial obligations owed to an exiting employee. This final settlement definition typically encompasses unpaid salary, reimbursements, leave encashment, and any incentive payouts. In many countries, additional components like pensions, healthcare benefits, or severance packages may also come into play, depending on local labor statutes and organizational policies.

Because F&F covers such a wide spectrum of financial elements, it requires meticulous planning and coordination across multiple departments—most commonly HR, Finance, and Legal. Missteps in calculation or communication can lead to disputes, reputational harm, and potential legal action in jurisdictions worldwide.

1.2. Legal and Financial Implications of F&F Settlement

The Full and Final Settlement (F&F) settlement process is a global concept but is shaped by local laws and practices. A properly executed full and final settlement is more than just good practice—it is a legal obligation codified in various statutes and labor norms across countries.Employers who fail to disburse final dues accurately and on time can face legal repercussions such as fines, employee litigation, or regulatory scrutiny.

From a financial standpoint, inaccuracies in the F&F process—like payroll mismatches or missed deductions—can lead to significant overheads in corrective actions and damage to organizational credibility.

1.3. Importance of Transparency in F&F Processes

Organizations worldwide that emphasize transparent communication during the employee exit process significantly reduce misunderstandings and conflicts. By clearly explaining how amounts like leave encashment, bonus, or gratuity are computed, HR professionals foster trust and credibility—even when employees are leaving the organization. This transparency is a core facet of modern HR best practices.

1.4. Full and Final Settlement Process in Different Countries

While the concept of Full and Final Settlement (FnF) remains the same—clearing all financial obligations between an organization and a departing employee—the specifics can vary widely depending on local laws, cultural norms, and industry practices. Below is an overview of how the FnF process is handled in different regions:

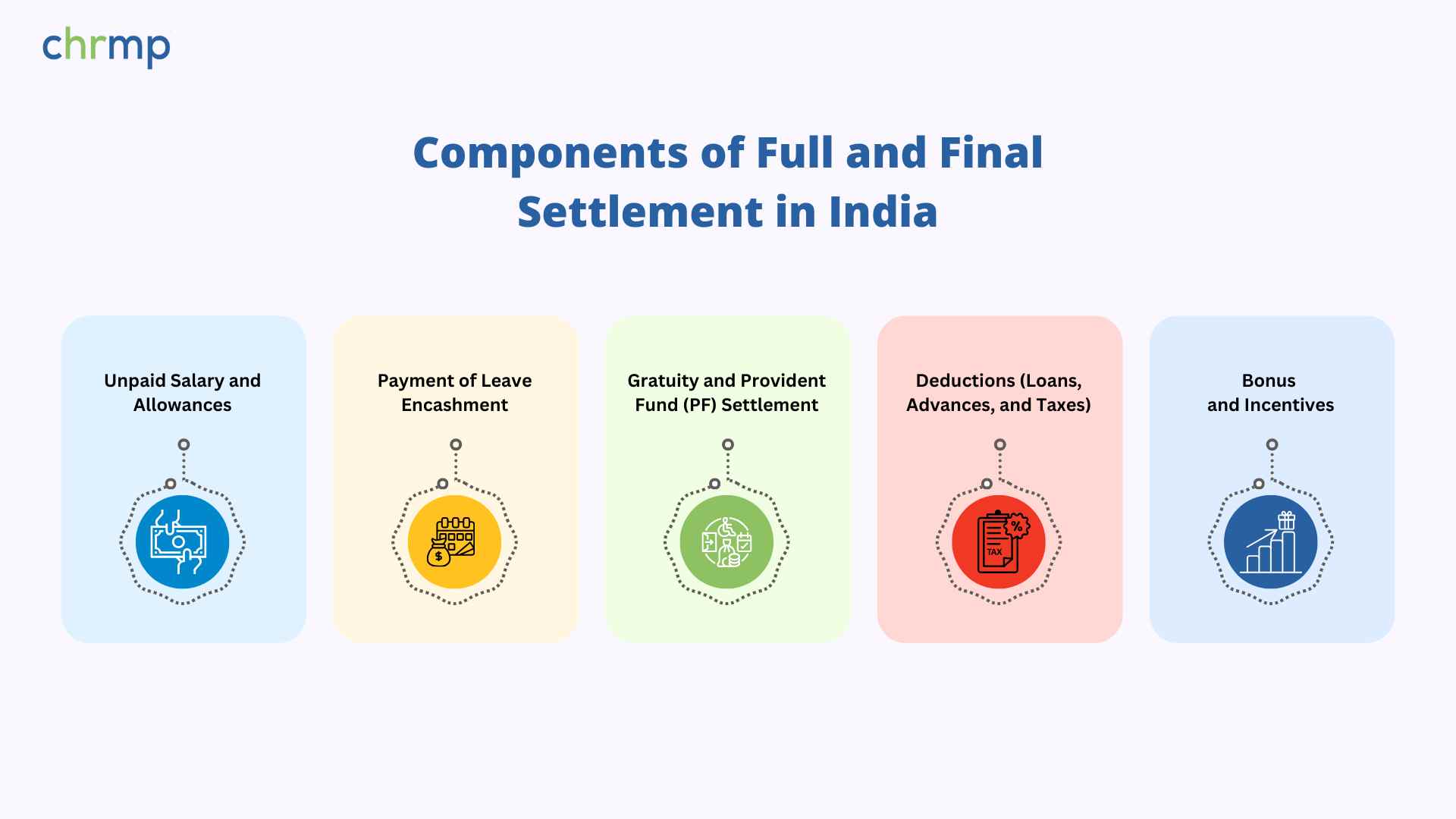

An F&F (Full and Final) settlement workflow in India typically involves multiple components to ensure that all outstanding dues of an employee are accurately settled. A clear understanding of these components is essential to prevent any oversight in salary, gratuity, leave encashment, provident fund, and other statutory payments.

2.1. Unpaid Salary and Allowances

The base salary and any outstanding allowances (e.g., housing allowance, travel allowance) form the foundation of the full and final settlement. HR must coordinate with Finance to reconcile attendance records and check for any arrears or pending increments.

2.2. Payment of Leave Encashment

If an employee has accumulated paid leaves that haven’t been used, they are eligible for leave encashment. This encashment amount is added to the final payroll calculation. The organization’s policy—aligned with Indian labor laws—determines whether all unused leaves or only certain types (e.g., earned leaves) are encashable.

2.3. Gratuity and Provident Fund (PF) Settlement

Gratuity: Under the Payment of Gratuity Act (applicable in India), employees with five or more years of continuous service are entitled to gratuity.

Provident Fund (PF): Both the employer and employee contribute to the PF account. During the employee exit process, PF settlement (or transfer) is initiated. Delays in PF settlement can lead to penalties or interest charges for the employer.

2.4. Deductions (Loans, Advances, and Taxes)

It’s equally important to account for any outstanding loans or salary advances provided to the employee. Employers may deduct these amounts from the F&F process. Additionally, HR must ensure the correct calculation of tax deductions (TDS) to comply with statutory regulations.

2.5. Bonus and Incentives

Annual performance bonuses or sales incentives might still be pending at the time of resignation or termination. These need to be factored into the final settlement definition. Companies that overlook these payouts risk damaging trust and face potential legal implications.

Effectively managing a Full and Final (F&F) settlement workflow requires a standardized process often documented as F&F process steps that outlines key steps, responsibilities, and timelines. In India, this involves compliance with statutory requirements like provident fund clearances, gratuity, and tax deductions. Clear communication with employees is essential to ensure transparency and a smooth transition. A well-structured full and final settlement (F&F) enhances efficiency while fostering trust and professionalism in the offboarding process.

3.1. Notice Period Management and Exit Clearance

Initiating the Exit Process

In India, notice periods commonly range from 30 to 90 days, depending on the terms of the employment contract or the company’s policy.

The exit process begins when the employee formally resigns or receives a termination notice. It’s crucial to track the exact notice period to determine any pay-in-lieu implications if the employee doesn’t serve the full term.

Asset and Clearance Tracking

Alongside managing the notice period, collect company assets such as ID cards, laptops, phones, or other equipment.

Some states may have specific requirements under Shops and Establishments Acts, so ensure you comply with local laws while obtaining exit clearances from IT, Finance, and Admin departments.

3.2. Documentation and Approvals for Final Settlement

Core Documentation

Exit Forms: Signed by the employee, confirming their resignation and last working day.

Clearance Forms: Obtain sign-offs from various departments (Finance, IT, Admin, etc.) to confirm that the employee has no pending dues or assets.

Bank Details: Verify updated bank account information to credit final dues accurately.

Leveraging Technology

Checklists or HRIS systems can help automate reminders for pending approvals, ensuring no step is overlooked.

Digital archives make it easy to retrieve signed documents and speed up the final settlement process, aligning with modern HR best practices in India.

3.3. Calculating and Disbursing the Final Amount

Once all department-level clearances are in place, HR and Finance collaborate on the final payroll calculation.

Unpaid salary + allowances

Leave encashment

Gratuity (if eligible)

Bonus/incentives

(-) Deductions such as loans, advances, or notice period pay

(-) Taxes and other statutory contributions

After internal approvals, the final payout is credited to the employee’s bank account. An itemized F&F process statement helps maintain transparency and clarity.

3.4. Issuing Relieving and Experience Letters

Though not strictly a financial element, relieving and experience letters are integral to the employee exit process. Issuing these letters promptly can positively influence an employee’s perception of the organization, thus maintaining goodwill.

3.5. Conducting Exit Interviews for Feedback

Exit interviews offer valuable insights into workplace culture, managerial practices, and potential areas of improvement. A well-structured exit interview can help refine the F&F settlement workflow and identify emerging F&F issues or payroll challenges.

4.1. Legal Timeframe for Settlements (As per the Payment of Wages Act)

In India, the law typically requires employers to settle wages within a stipulated timeframe—often within two working days to a month after the last working day. However, this can vary based on organizational policy or industry-specific regulations. Staying updated on Indian labor laws is crucial for F&F settlement compliance.

4.2. Taxation Rules on Final Payments

Taxes on the full and final settlement are governed by the Income Tax Act. HR must ensure that TDS is deducted appropriately from any additional components such as leave encashment, bonuses, or ex-gratia payments. Failing to comply can trigger audits and penalties.

4.3. Compliance with Labor Laws: PF, Gratuity, and Other Dues

Apart from the Payment of Wages Act, employers must also comply with:

The Employees’ Provident Funds and Miscellaneous Provisions Act

The Payment of Gratuity Act

Shops and Establishments Act (varies by state)

Non-adherence can result in legal disputes, financial penalties, and reputational damage.

Even with a robust F&F process steps framework, HR professionals can encounter hurdles that complicate HR payroll settlement.

5.1. Resolving Discrepancies in Dues or Calculations

Discrepancies often arise from inaccurate attendance records, payroll data misalignment, or miscalculation of leaves. Clearer SOPs and integrated HR software solutions minimize these errors.

5.2. Managing Disputes Over Notice Period or Compensation

Some employees may contest the length of their notice period, severance pay, or final compensation. Proactively addressing these points in employment contracts and maintaining consistent application of policies can reduce friction.

5.3. Ensuring Timely Approvals Across Departments

F&F issues can magnify when multiple departments (Finance, Legal, IT) fail to communicate efficiently. Establish a single point of contact—typically an HR representative—to track the F&F settlement workflow and ensure all approvals occur before deadlines.

5.4. Addressing Legal Claims or Liabilities

Occasionally, ex-employees may initiate legal action if they believe they were underpaid or unlawfully terminated. Thorough documentation of every employee exit process step helps protect the organization in such cases.

Technology can play a pivotal role in automating and streamlining F&F settlement workflow processes, mitigating payroll challenges, and ensuring HR compliance.

6.1. How HRIS and Payroll Tools Streamline the Process

F&F Automation: HRIS tools offer built-in payroll tools that automatically calculate final dues, adjusting for leaves, deductions, and taxes.

Integration: Modern solutions connect with attendance systems, ensuring real-time data flow.

Notifications: Auto-reminders prompt stakeholders about pending approvals or documentation.

6.2. Templates for Final Settlement Calculations

Standardized templates prevent oversight. A comprehensive template might include fields for:

Basic salary, allowances, incentives, and variable pay

Unused leaves and gratuity

PF, ESI, or any other statutory deduction

Net payable amount with a breakdown of each component

6.3. Recommended Tools for F&F Documentation and Compliance

Cloud Storage Platforms (e.g., Google Drive, OneDrive) for secure record-keeping

Digital Signature Solutions (e.g., DocuSign) to speed up approvals

Project Management Tools (e.g., Trello or Asana) to track F&F progress and tasks across departments

A well-managed full and final settlement is more than a mere administrative necessity. It’s a reflection of your organization’s culture, integrity, and commitment to fairness. By prioritizing transparency, leveraging F&F automation tools, adhering to Indian labor laws, and following HR best practices, you can create an F&F process that not only maintains employer-employee goodwill but also minimizes legal risks and HR compliance hurdles.

Ready to take your F&F process to the next level? Explore our specialized HR Certification courses to gain deeper insights into F&F settlement workflow, payroll tools, and advanced HR best practices. Empower yourself and your organization by ensuring every exit is as positive and compliant as every entry!

Below are some of the most common questions HR professionals ask about full and final settlement. Integrating the answers into your F&F process can improve transparency and reduce confusion.

What is full and final settlement in HR?

Full and final settlement, or F&F meaning, is the process of clearing all pending dues owed to an exiting employee, including salary, allowances, bonuses, and statutory contributions, ensuring a legally and financially clean break between employee and employer.

What components are included in a full and final settlement?

Typical F&F components include unpaid salary, leave encashment, gratuity, PF, bonuses, incentives, and relevant deductions (loans, advances, TDS).

How is the F&F amount calculated for employees?

Final payroll calculation involves summing up the total unpaid salary, allowances, and benefits while subtracting advances or loans, tax deductions, and any penalties for short notice. Tools like HRIS can automate these calculations to prevent errors.

What is the legal timeframe for completing F&F settlement in India?

Under Indian labor laws and the Payment of Wages Act, employers generally need to settle wages within a specified timeframe (commonly within 2–30 days) post the last working day. Different states or sectors may have specific rules, so always refer to local statutory regulations.

Are taxes applicable on full and final settlements?

Yes. Employers must deduct TDS from certain F&F components (like bonuses) based on the relevant tax slabs. Compliance ensures F&F settlement aligns with statutory regulations and avoids legal complications.

What challenges do HR professionals face in managing F&F processes?

Common F&F issues and payroll challenges include miscalculations, discrepancies in attendance and leave data, disputes over notice period, delayed approvals, and potential legal claims if employees feel underpaid or wrongfully terminated.

How can automation help in streamlining F&F settlements?

F&F automation through HR software or payroll tools reduces manual errors, sets reminders for stakeholders, and provides real-time access to data. Automated processes free up HR resources to focus on strategic tasks rather than administrative follow-ups.

What documents are required for the F&F process?

Key documents include resignation/termination letters, clearance forms from various departments, updated bank details, and any loan or advance agreements. Maintaining these in a centralized database ensures smooth F&F process steps.

Can employees dispute their final settlement amount?

Yes. Employees can legally challenge inaccurate calculations or delayed settlements. Maintaining F&F settlement compliance and transparent documentation helps HR resolve disputes efficiently or avoid them altogether.

How does a smooth F&F process benefit the organization?

An effective exit process reflects positively on your employer brand, reduces the risk of legal action, and fosters goodwill. Departing employees who experience a hassle-free and fair settlement are more likely to recommend the organization and may even consider returning in the future.

© 2007-2025 CHRMP| All Rights Reserved | Powered by Ripples Learning & Research Private Limited