The concept of compensation and benefits has evolved significantly over the centuries, reflecting changes in societal norms, economic conditions, and workplace expectations. From its rudimentary beginnings to its sophisticated forms today, the development of compensation and benefits offers valuable insights into how businesses and workers have interacted over time.

The roots of compensation can be traced back to ancient civilizations. In agricultural societies, compensation was often tied to subsistence, with workers receiving food, shelter, or other necessities in return for their labor. For example, ancient Egyptian laborers building pyramids were compensated with rations of bread and beer, aligning with the barter systems of their time.

The concept of benefits began to take shape during the Roman Empire. Soldiers in the Roman legions were granted pensions and land as rewards for their service, laying the groundwork for early non-monetary benefits. These forms of recognition acknowledged the value of loyalty and long-term service, even in pre-industrial economies.

The Industrial Revolution marked a turning point in the history of compensation and benefits. As economies transitioned from agrarian to industrial, the labor market expanded, and employers began to adopt standardized wages to attract workers. With factories employing large numbers of people, monetary compensation became more formalized, often calculated on a daily or hourly basis.

Benefits also began to take on new dimensions during this period. For instance, some companies in the late 19th and early 20th centuries introduced early versions of employee benefits, such as housing or healthcare services, to enhance worker loyalty. The paternalistic approach of companies like Pullman in the United States provided workers with amenities like housing, albeit with significant control over their personal lives.

The mid-20th century heralded a revolution in the way compensation and benefits were structured. World War II played a pivotal role in this transformation. With government-imposed wage caps in place, employers began to offer non-monetary benefits, such as health insurance and retirement plans, to attract talent. This era saw the birth of the total rewards approach, which emphasized a mix of financial and non-financial incentives.

By the 1970s and 1980s, organizations began incorporating merit-based pay and performance bonuses into compensation structures. Employee benefits expanded to include paid time off, wellness programs, and tuition reimbursement. Governments also played a role by instituting minimum wage laws, worker protection regulations, and tax advantages for certain types of benefits.

Today, compensation and benefits have become highly strategic and employee-centered. Organizations leverage technology and data analytics to craft personalized packages tailored to employee needs and preferences. Compensation is no longer just about base pay; it encompasses variable pay structures, equity-based rewards, and incentives tied to individual or organizational performance.

Similarly, benefits have expanded to address the holistic well-being of employees. Flexible work arrangements, mental health support, parental leave, and wellness stipends are just a few examples of the modern benefits landscape. Companies also focus on diversity, equity, and inclusion (DEI) initiatives to ensure compensation practices are fair and transparent.

For instance, tech giants like Google and Salesforce not only offer competitive salaries but also comprehensive benefits, including on-site wellness facilities, extended family leave policies, and educational opportunities. These practices highlight the importance of staying ahead in a competitive talent market.

Compensation and benefits are critical tools for attracting, retaining, and motivating employees. They represent the tangible and intangible value that organizations provide in exchange for employee contributions, forming the basis of an employer-employee relationship.

The compensation definition focuses on direct financial payments made to employees, such as salaries, hourly wages, bonuses, and equity-based incentives. These are tangible rewards directly tied to an employee’s performance, role, and market value.

On the other hand, the benefits meaning encompasses non-monetary rewards provided to enhance an employee’s overall quality of life. These include healthcare plans, retirement savings programs, paid time off, and wellness initiatives. Together, these elements form the total rewards package, a comprehensive approach to employee recognition and value delivery.

From the employer’s perspective, compensation and benefits represent a strategic investment in the organization’s most valuable resource: its people. Compensation serves as a tangible acknowledgment of an employee’s contributions to achieving organizational goals, while benefits demonstrate a commitment to their holistic well-being. Together, they create a compelling employee value proposition (EVP) that not only attracts top talent but also fosters loyalty and engagement. From the employee’s perspective, compensation is seen as a direct reflection of their skills, experience, and market worth, while benefits enhance their quality of life and provide security for their future. For both parties, aligning compensation and benefits effectively is crucial; employers must design packages that meet business objectives while addressing employees’ needs and aspirations. Mapping out a well-rounded compensation and benefits strategy ensures transparency, fairness, and mutual satisfaction, creating a foundation for a motivated and high-performing workforce.

The Equity Theory of Motivation (Adams, 1963) reinforces the importance of fairness in compensation and benefits. Employees compare their input-output ratio (effort versus rewards) with their peers. When they perceive equity, their motivation and job satisfaction improve. On the other hand, perceived inequities can lead to disengagement or attrition.

Employers must also align their rewards strategy with Maslow’s Hierarchy of Needs:

By adopting these theoretical foundations, HR professionals can create compensation and benefits packages that are not only fair but also deeply motivating.

One discussion that stands out then is how compensation and benefits have transcended their traditional role as operational necessities. Today, they are indispensable strategic tools for achieving organizational goals, ensuring alignment between employee performance and business outcomes. A well-designed compensation and benefits framework not only fulfills basic expectations but also drives attraction, retention, and motivation—the three pillars of an engaged and productive workforce.

To secure top talent, organizations must differentiate themselves in a crowded labor market. Competitive compensation packages combined with meaningful benefits create a compelling employee value proposition (EVP) that resonates with candidates.

Steps for Building an Attractive Package:

Example:

Tech companies like Google and Meta not only offer competitive salaries but also stock options, parental leave, and wellness stipends. These benefits appeal to high-performing professionals who prioritize long-term financial security and work-life balance. By clearly presenting their EVP, these companies continuously attract top innovators.

Retention is a critical metric for HR professionals, as high employee turnover leads to increased costs for recruitment, onboarding, and training. Compensation and benefits significantly contribute to an employee’s decision to stay with an organization. A comprehensive rewards strategy signals to employees that their contributions are valued and recognized, fostering loyalty.

Steps for Retention Through Compensation and Benefits:

Example:

Retail giant Starbucks has implemented a robust benefits package for its employees, including healthcare coverage, tuition assistance, and stock options for part-time workers. These offerings contribute to lower turnover rates and higher engagement among staff, even in an industry notorious for high attrition.

Compensation and benefits play a pivotal role in motivating employees to achieve organizational goals. When employees perceive their rewards as fair and tied to performance, they are more likely to align their efforts with the company’s objectives. The Expectancy Theory of Motivation (Vroom, 1964) supports this idea, suggesting that employees are motivated when they believe their efforts will result in desired outcomes, such as bonuses or career advancement.

Steps to Enhance Motivation:

Example:

Manufacturing leader 3M incorporates a mix of financial incentives, performance-based rewards, and personal development benefits. Employees are encouraged to spend 15% of their time on innovative projects, with the promise of additional funding and career growth opportunities for successful ideas. This unique reward system fosters creativity and alignment with the company’s long-term goals.

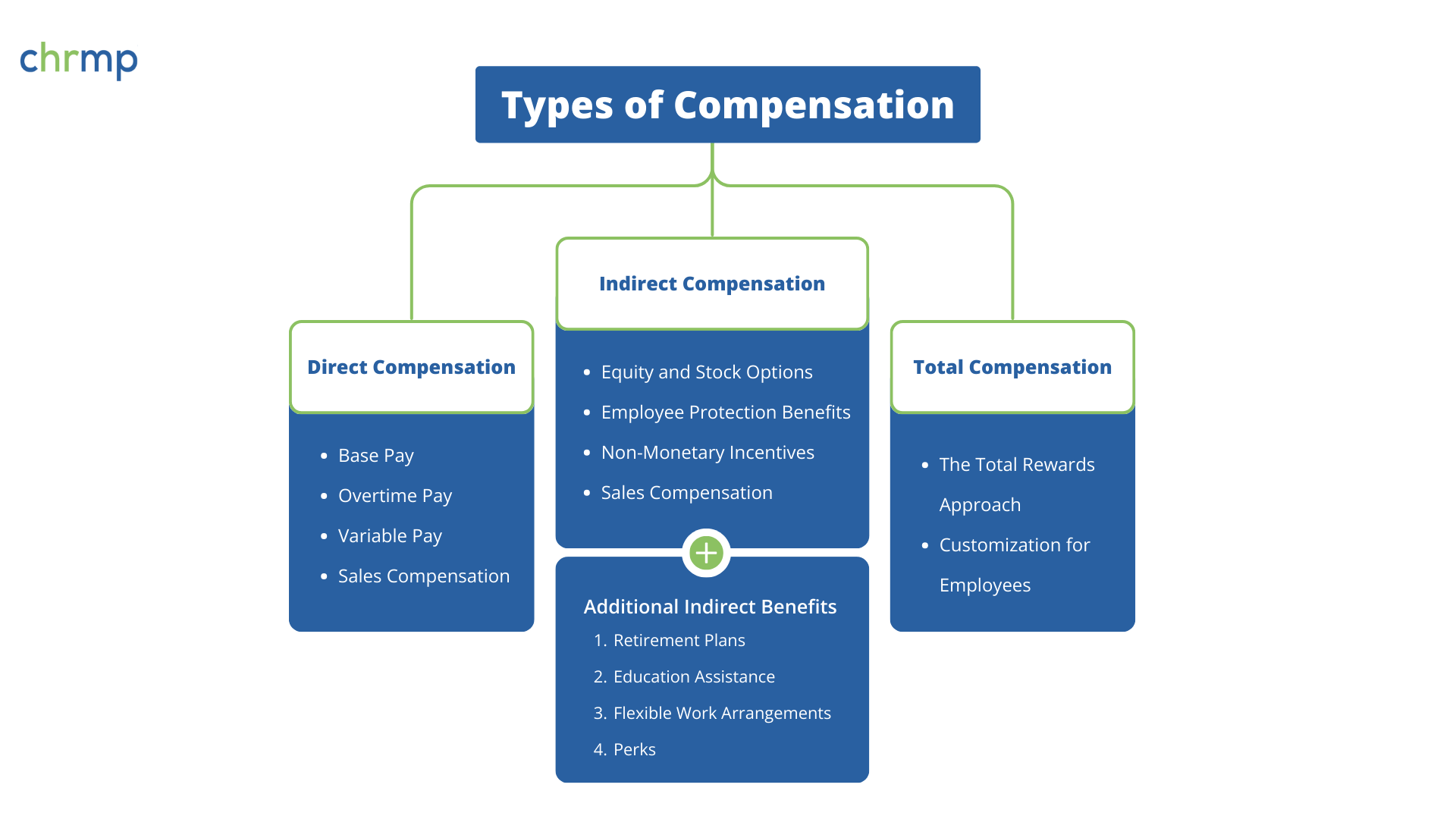

Compensation is a fundamental component of the total rewards strategy, encompassing all financial and non-financial rewards provided to employees. It plays a crucial role in attracting, retaining, and motivating talent. Compensation can be broadly categorized into direct compensation and indirect compensation, which together form an employee’s total compensation package. Understanding these distinctions is essential for HR professionals to craft equitable and competitive rewards systems.

Direct compensation refers to the monetary rewards employees receive for their work. It is a tangible, immediate form of payment that can be further broken down into various components designed to address specific roles, responsibilities, and performance outcomes.

Base Pay

Base pay constitutes the fixed salary or hourly wages employees receive, forming the foundation of direct compensation. It reflects the value of a position based on industry standards, the employee’s qualifications, and market competitiveness.

Overtime pay is compensation provided for hours worked beyond the standard workweek, typically at a premium rate. It ensures fair remuneration for additional effort and encourages compliance with labor laws.

Variable pay includes bonuses, performance-based incentives, and profit-sharing arrangements. It links compensation to individual or organizational performance, motivating employees to achieve specific goals.

Sales compensation is tailored to incentivize employees in sales roles, typically combining base pay with commissions or sales incentives. This structure rewards results and drives revenue growth.

Indirect compensation encompasses non-monetary benefits and perks that enhance an employee’s overall well-being and job satisfaction. These offerings, though not part of direct pay, hold immense value and contribute significantly to an employee’s total compensation.

Equity-based compensation, such as stock options or restricted stock units (RSUs), provides employees with ownership stakes in the organization. This aligns their interests with long-term company growth.

Protection benefits include insurance (health, life, and disability), retirement plans, and wellness programs. These offerings safeguard employees against unforeseen risks and support their financial security.

Non-Monetary Incentives

Non-monetary incentives focus on recognition and work-life balance, such as flexible work schedules, professional development opportunities, and rewards for outstanding performance.

Additional Indirect Benefits:

Total Compensation

Total compensation combines all elements of direct and indirect compensation to represent the comprehensive value of what employees receive in exchange for their work. It reflects an organization’s commitment to rewarding its employees holistically.

The Total Rewards Approach

Total compensation is integral to the broader total rewards strategy, which includes career development opportunities, recognition programs, and workplace culture in addition to pay and benefits. This approach ensures that employees feel valued in every aspect of their professional journey.

Customization for Employees

Tailoring total compensation to meet diverse employee needs is crucial in today’s workforce, where priorities differ across generations and job roles.

Employee benefits are integral to modern compensation strategies, offering non-salary perks that enhance an employee’s overall quality of life. A well-rounded benefits package addresses diverse employee needs, promoting satisfaction, engagement, and loyalty. Below, we explore the key employee benefits categories, each designed to provide value in unique ways.

At-work benefits focus on improving the employee experience within the workplace and facilitating professional growth. These benefits create a supportive and empowering work environment, enabling employees to perform at their best.

Flexible work arrangements allow employees to adjust their schedules, accommodating personal commitments without compromising productivity.

PTO policies provide employees with paid leave for vacation, illness, or personal needs, ensuring rest and recovery while maintaining financial security.

Skills Development Opportunities

Investing in employees’ professional growth fosters engagement and enhances productivity. Training programs, certifications, and leadership development initiatives fall under this category.

Health benefits address an employee’s physical and mental well-being. These benefits not only promote healthier lifestyles but also contribute to reduced absenteeism and increased productivity.

Comprehensive healthcare plans cover medical, dental, and vision care, ensuring that employees and their families are protected against high medical costs.

Wellness programs motivate employees to adopt healthy habits through fitness reimbursements, gym memberships, or wellness challenges.

Financial benefits offer employees stability and support for future planning. These benefits cater to long-term financial health and short-term security, promoting peace of mind.

Retirement plans, such as 401(k)s and pensions, help employees save for the future, often with employer-matching contributions to accelerate growth.

Comprehensive insurance offerings include life, disability, and accident insurance, protecting employees against unexpected events.

Financial wellness programs, such as debt counseling, student loan repayment, and budgeting workshops, address immediate financial concerns.

Lifestyle benefits align with the evolving priorities of today’s workforce, focusing on flexibility and balance between professional and personal life.

Remote work options allow employees to work from home or any location, fostering autonomy and reducing commuting stress.

Work-Life Balance Programs

These programs include on-site childcare, family leave, or wellness stipends, ensuring employees can prioritize personal responsibilities alongside work.

Compensation and benefits are more than financial incentives—they are powerful tools that shape an organization’s ability to attract, retain, and engage its workforce. These rewards, whether direct or indirect, significantly influence employee motivation, job satisfaction, and overall organizational success. Below, we explore the critical roles compensation and benefits play, supported by real-world examples and case studies.

A well-structured compensation and benefits package is a magnet for skilled professionals in today’s competitive job market. Talented candidates assess not only base salary but also perks, bonuses, and non-monetary benefits when considering job offers.

Example:

Google has consistently ranked as a top employer due to its competitive compensation strategy. Beyond offering salaries that match or exceed market standards, the company provides unique benefits such as free meals, fitness centers, and equity-based rewards. These perks have helped Google build a reputation as an employer of choice, drawing top talent from across the globe.

Google’s strong benefits offering has resulted in consistently high application rates, with over two million applications received annually, demonstrating its ability to attract the best candidates.

Engaged employees are motivated, productive, and committed to their work. Compensation and benefits directly impact engagement by showing employees that their efforts are valued and rewarded.

Example

Salesforce enhances employee engagement through comprehensive benefits, including generous parental leave, on-site childcare, and equity-based rewards. The company also supports employee well-being with wellness stipends and mental health programs.

Salesforce’s approach has earned it a consistent spot on Fortune’s “100 Best Companies to Work For,” with high employee satisfaction scores and low disengagement rates.

Retention is a critical concern for organizations, as turnover leads to significant costs and disruption. Fair and attractive compensation and benefits reduce attrition by fostering a sense of loyalty among employees.

Example

Starbucks demonstrates the importance of benefits in retention through its comprehensive offerings, including healthcare for part-time employees, stock options, and tuition reimbursement. These programs signal that the company values long-term employee contributions.

Starbucks reports lower turnover rates compared to industry averages, which has translated into cost savings and a consistent customer experience.

Compensation and benefits empower employees to focus on achieving organizational goals. When employees feel financially secure and valued, they are more likely to contribute their best efforts.

Example

Microsoft combines competitive salaries with equity-based rewards, ensuring employees feel invested in the company’s long-term success. The company also offers substantial bonuses tied to individual and team performance, reinforcing a culture of accountability and achievement.

Microsoft’s performance-based approach has driven innovation and helped retain top performers, contributing to its sustained market leadership.

Human Resources (HR) plays a pivotal role in shaping and managing compensation and benefits programs that align with organizational goals while addressing employee needs. Through strategic planning, effective communication, and meticulous compliance management, HR ensures that these programs remain fair, competitive, and sustainable. Below is a detailed action plan for HR professionals to follow when initiating or refining their compensation and benefits strategies.

The compensation philosophy is the foundation of an organization’s approach to employee rewards. It outlines how the company values and prioritizes pay equity, competitiveness, and internal alignment.

Action Plan:

Effective compensation and benefits strategies require thorough planning, analysis, and execution. These strategies must be tailored to the organization’s unique structure and workforce demographics.

Action Plan:

Regulatory compliance is a critical aspect of compensation and benefits management. Non-compliance can result in financial penalties and damage to the organization’s reputation.

Action Plan:

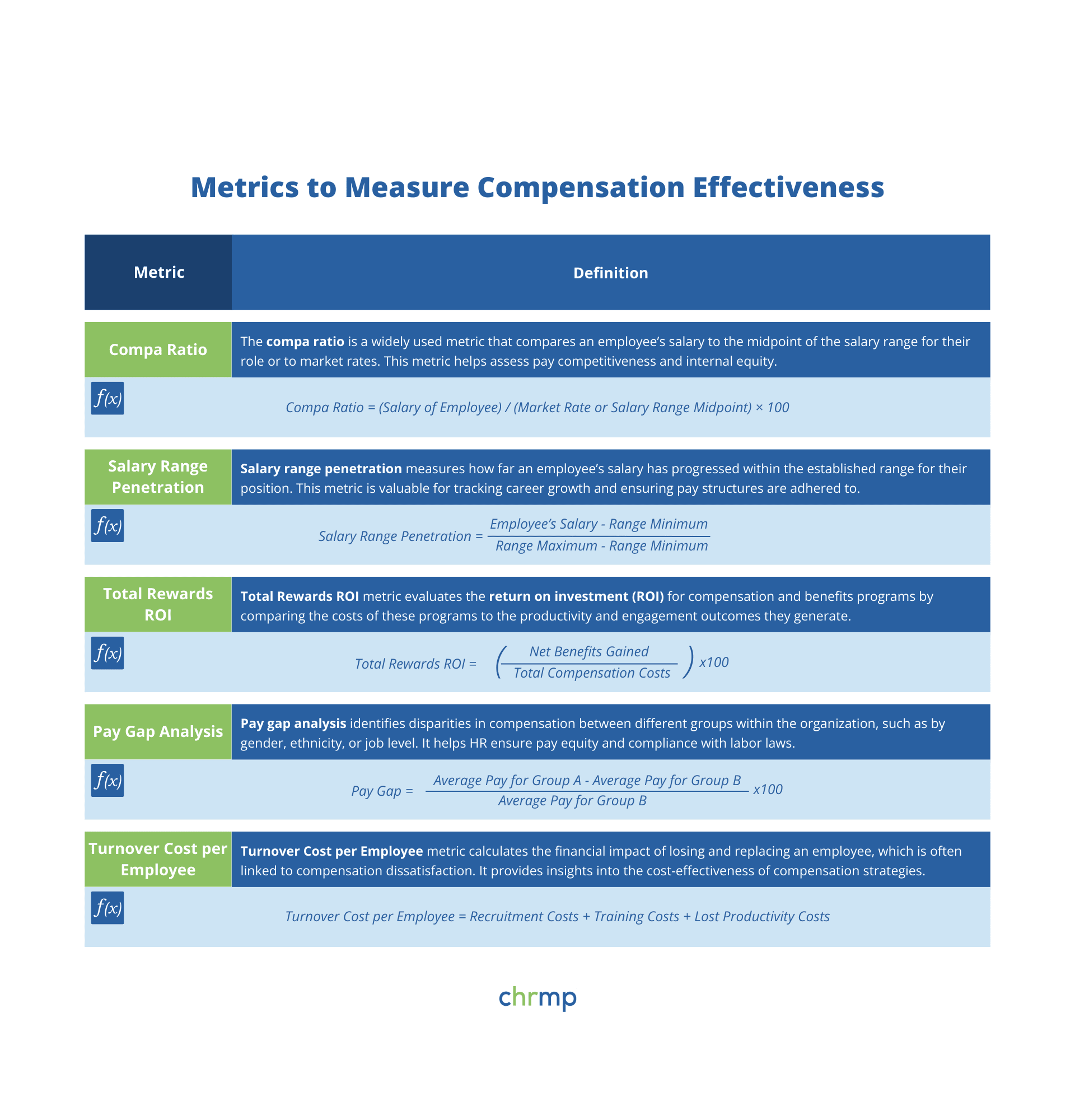

Measuring the effectiveness of compensation programs is essential for HR professionals to ensure alignment with organizational goals and market standards. Using compensation metrics, organizations can assess whether their pay strategies attract, retain, and motivate employees effectively. Below are detailed explanations of key metrics, along with formulas, applications, and additional metrics to provide a comprehensive evaluation.

Compa Ratio

The compa ratio is a widely used metric that compares an employee’s salary to the midpoint of the salary range for their role or to market rates. This metric helps assess pay competitiveness and internal equity.

Formula:

Compa Ratio=Salary of Employee)/(Market Rate or Salary Range Midpoint×100

Interpretation:

Application:

HR professionals can use compa ratios to ensure equity within teams and departments. For example, in a technology firm, a software developer earning $90,000 in a market where the midpoint salary is $100,000 would have a compa ratio of 90%. This could indicate room for adjustment during performance reviews or merit increases.

Salary Range Penetration

Salary range penetration measures how far an employee’s salary has progressed within the established range for their position. This metric is valuable for tracking career growth and ensuring pay structures are adhered to.

Formula:

Salary Range Penetration=Employee’s Salary-Range MinimumRange Maximum-Range Minimum×100

Interpretation:

Application:

For instance, an HR manager earning $70,000 in a range of $60,000–$90,000 would have a penetration of 33.3%. This insight can guide HR in determining whether the manager’s compensation aligns with their performance and tenure.

Total Rewards ROI

This metric evaluates the return on investment (ROI) for compensation and benefits programs by comparing the costs of these programs to the productivity and engagement outcomes they generate.

Formula:

Total Rewards ROI=Net Benefits GainedTotal Compensation Costs×100

Interpretation:

Application:

If a company spends $1 million on compensation programs and observes a $1.2 million increase in productivity, the ROI is:

Total Rewards ROI=1.2-11×100=20%

This indicates that for every dollar spent, the company gains $1.20 in value, justifying the investment.

Pay Gap Analysis

Pay gap analysis identifies disparities in compensation between different groups within the organization, such as by gender, ethnicity, or job level. It helps HR ensure pay equity and compliance with labor laws.

Formula:

Pay Gap=Average Pay for Group A-Average Pay for Group BAverage Pay for Group B×100

Interpretation:

Application:

For example, if male employees in a role earn $80,000 on average, while female employees earn $72,000, the pay gap is:

Pay Gap=80,000-72,00080,000×100=10%

This highlights a need for HR to investigate potential inequities and make adjustments.

Turnover Cost per Employee

This metric calculates the financial impact of losing and replacing an employee, which is often linked to compensation dissatisfaction. It provides insights into the cost-effectiveness of compensation strategies.

Formula:

Turnover Cost per Employee=Recruitment Costs+Training Costs+Lost Productivity Costs

Application:

If recruitment costs for a role are $5,000, training costs $3,000, and lost productivity is estimated at $7,000, the total turnover cost per employee is $15,000. This emphasizes the importance of competitive compensation in reducing turnover.

© 2007-2025 CHRMP| All Rights Reserved | Powered by Ripples Learning & Research Private Limited